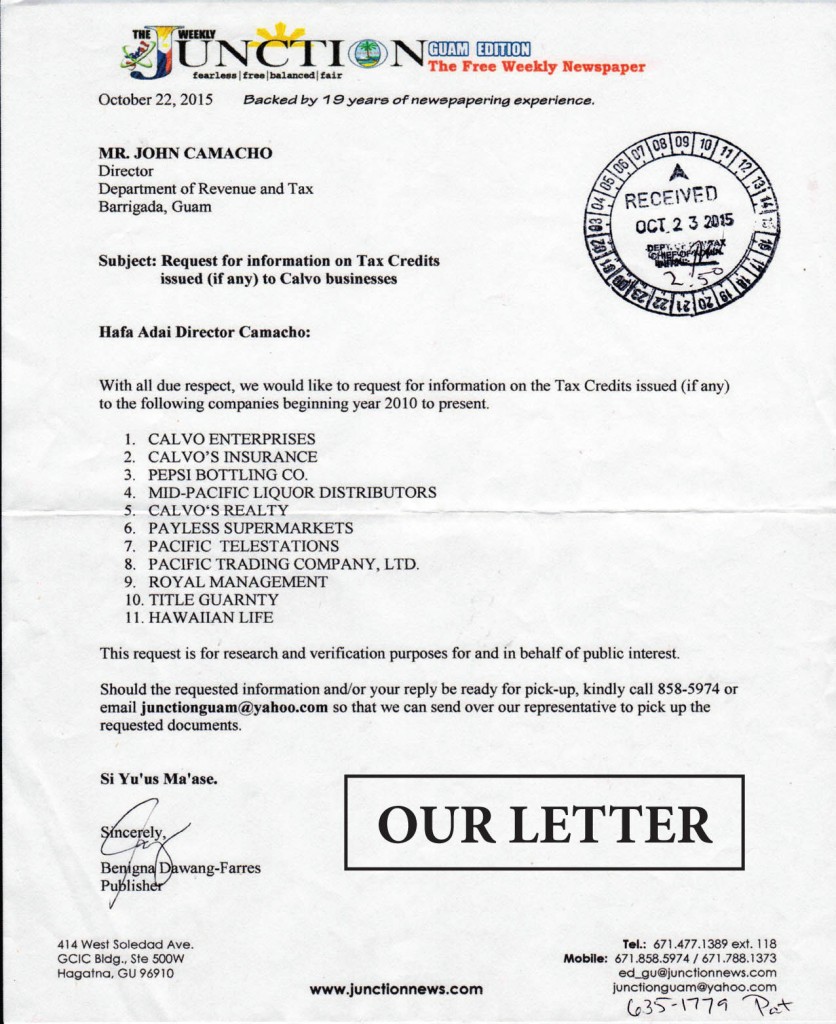

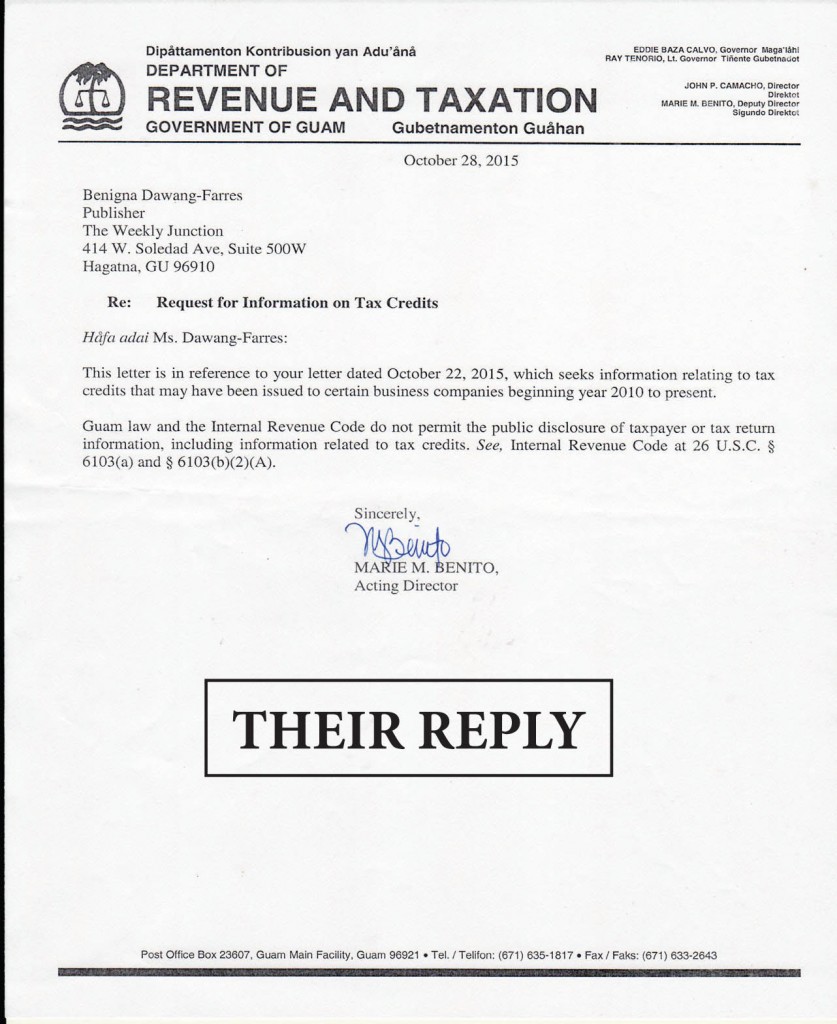

It is most unfortunate that the Department of Revenue and Taxation had cited “Internal Revenue Code at 26 U.S.C. & 6103 (a) and 6103 (b) (2) (A)”, (refer to this section quoted hereunder ) as their reason for non disclosure of our simple inquiry, refer to our letter inquiry dated October 22, 2015 and the Rev & Tax letter reply dated October 28, 2015.

Whether or not the refusal of the Rev & Tax is with valid legal basis is for the lawyers and/or courts to determine, and while we have not yet secured the available legal remedies at our disposal in order to secure the documents, we believe that the Department of Revenue and Taxation, should it consider that there may be private information that may be subject to FOIA exemptions, could simply redact and/or delete such specific private information.

While our letter request did not indicate that it is a FOIA request, nevertheless the request is for media information and dissemination purposes which is for and in behalf of the public interest and transparency, which is the very essence intent and spirit of the FOIA.

We will send a FOIA request (re-word our letter) to the Rev & Tax and we will keep you posted on the developments.

In the meantime, quoted hereunder are salient provisions on the FOIA exemptions from (http://www.foia.gov/faq.html#exemptions, IRS : https://www.irs.gov/pub/irs-utl/irs_foia_guide.pdf and https://www.law.cornell.edu/uscode/text/26/6103)

26 U.S. Code § 6103 – Confidentiality and disclosure of returns and return information

(a) General rule

Returns and return information shall be confidential, and except as authorized by this title—

(1) no officer or employee of the United States,

(2) no officer or employee of any State, any local law enforcement agency receiving information under subsection (i)(7)(A), any local child support enforcement agency, or any local agency administering a program listed in subsection (l)(7)(D) who has or had access to returns or return information under this section or section 6104 (c), and

(3) no other person (or officer or employee thereof) who has or had access to returns or return information under subsection (e)(1)(D)(iii),subsection (k)(10), paragraph (6), (10), (12), (16), (19), (20), or (21) of subsection (l), paragraph (2) or (4)(B) of subsection (m), orsubsection (n),

shall disclose any return or return information obtained by him in any manner in connection with his service as such an officer or an employee or otherwise or under the provisions of this section. For purposes of this subsection, the term “officer or employee” includes a former officer or employee.

(2) Return information

The term “return information” means—

(A) a taxpayer’s identity, the nature, source, or amount of his income, payments, receipts, deductions, exemptions, credits, assets, liabilities, net worth, tax liability, tax withheld, deficiencies, over assessments, or tax payments, whether the taxpayer’s return was, is being, or will be examined or subject to other investigation or processing, or any other data, received by, recorded by, prepared by, furnished to, or collected by the Secretary with respect to a return or with respect to the determination of the existence, or possible existence, of liability (or the amount thereof) of any person under this title for any tax, penalty, interest, fine, forfeiture, or other imposition, or offense,

——–

What is the FOIA?

Since 1967, the Freedom of Information Act (FOIA) has provided the public the right to request access to records from any federal agency. It is often described as the law that keeps citizens in the know about their government. Federal agencies are required to disclose any information requested under the FOIA unless it falls under one of nine exemptions which protect interests such as personal privacy, national security, and law enforcement.

The FOIA also requires agencies to proactively post online certain categories of information, including frequently requested records. As Congress, the President, and the Supreme Court have all recognized, the FOIA is a vital part of our democracy.

Who can make a FOIA request?

Generally any person – United States citizen or not – can make a FOIA request.

What can I ask for under the FOIA?

A FOIA request can be made for any agency record. You can also specify the format in which you wish to receive the records (for example, printed or electronic form). The FOIA does not require agencies to create new records or to conduct research, analyze data, or answer questions when responding to requests.

How is a FOIA request processed?

After an agency receives your FOIA request, you will usually receive a letter acknowledging the request with an assigned tracking number. If the agency requires additional information before it can begin to process your request, it will contact you. The agency will typically search for records in response to your request and then review those records to determine which – and what parts of each – can be released. The agency will redact, or black out, any information protected from disclosure by one of the FOIA’s nine exemptions. The releasable records will then be sent to you.

What are FOIA exemptions?

Not all records can be released under the FOIA. Congress established certain categories of information that are not required to be released in response to a FOIA request because release would be harmful to a government or private interest. These categories are called “exemptions” from disclosures. Still, even if an exemption applies, agencies may use their discretion to release information when there is no foreseeable harm in doing so and disclosure is not otherwise prohibited by law. There are nine categories of exempt information and each is described below.

Exemption 1: Information that is classified to protect national security.

Exemption 2: Information related solely to the internal personnel rules and practices of an agency.

Exemption 3: Information that is prohibited from disclosure by another federal law.

Exemption 4: Trade secrets or commercial or financial information that is confidential or privileged.

Exemption 5: Privileged communications within or between agencies, including:

1. Deliberative Process Privilege

2. Attorney-Work Product Privilege

3. Attorney-Client Privilege

Exemption 6: Information that, if disclosed, would invade another individual’s personal privacy.

Exemption 7: Information compiled for law enforcement purposes that:

• 7(A). Could reasonably be expected to interfere with enforcement proceedings

• 7(B). Would deprive a person of a right to a fair trial or an impartial adjudication

• 7(C). Could reasonably be expected to constitute an unwarranted invasion of personal privacy

• 7(D). Could reasonably be expected to disclose the identity of a confidential source

• 7(E). Would disclose techniques and procedures for law enforcement investigations or prosecutions

• 7(F). Could reasonably be expected to endanger the life or physical safety of any individual

Exemption 8: Information that concerns the supervision of financial institutions.

Exemption 9: Geological information on wells.

Source: http://www.foia.gov/faq.html#exemptions

——-

The IRS may withhold an IRS record that falls under one of the FOIA’s nine statutory exemptions or by one of three exclusions.

FOIA Exemptions

The exemptions protect against the disclosure of information that would harm: national security, the privacy of individuals, the proprietary interests of business, the functioning of the government, and other important recognized interests.

An entire record is not necessarily exempt when a record contains some information that qualifies as exempt. Instead, the FOIA specifically provides that any reasonably segregable portions of a record must be provided to a requester after exempt portions are deleted. FOIA requires the IRS to identify the location of deletions in the released portion of the record and, where technologically feasible, to show the deletion at the place on the record where the deletion was made, unless including that indication would harm an interest protected by an exemption.

Exemption 6. Personal Privacy

Exemption 6 applies to personnel, medical, and similar files the disclosure of which would constitute a clearly unwarranted invasion of personal privacy. This exemption protects the privacy interests of individuals by allowing IRS to withhold personal data kept in its files where there is an expectation of privacy. Only individuals have privacy interests. Corporations and business associations have no privacy rights under the sixth exemption, with the exception of closely held corporations or similar business entities. Once it has been determined that a personal privacy interest is threatened by a requested disclosure , the exemption requires agencies to strike a balance between an individual’s privacy interest and the public’s interest in disclosure. The Privacy Act of 1974 also regulates the disclosure of personal information about an individual. The IRS will automatically consider a request for personal information under both the FOIA and the Privacy Act and will rely on the statute that provides the greater access.

Source: https://www.irs.gov/pub/irs-utl/irs_foia_guide.pdf